Social Security: How It Costs Young People Millions

The word on the street is that Social Security is likely to run out before anyone planning to retire in 20+ years sees a dime. According to Treasury Secretary Tim Geithner, that year is 2033.

Social Security and Medicare accounted for 36% of Federal expenses in 2011. And that number is only going to grow as Baby Boomers leave the workforce and enter retirement. A large portion of our population will both stop contributing and start taking money, which puts a huge strain on Social Security.

In other words, Social Security is the equivalent to a gigantic iceberg being dropped in the middle of the Sahara desert. It's only a matter of time before all the money melts away and all young people (retiring before 2033) will be left with is mud.

Before you start calling Congress to tell them to save Social Security, let's examine just how good of a deal Social Security really is...

A Short History Lesson

Franklin D. Roosevelt signed the Social Security Act in 1935 to combat 50% poverty levels amongst senior citizens. It was initially supposed to limit the major threats to the American way of life: old age, unemployment, poverty, and the financial burden of widows and fatherless children.

It sounded all fine and dandy. However, there are major flaws in the continuation of Social Security in today's modern society:

1. From "Old Age Insurance" to "Retirement Fund"

One of the reasons Social Security started was as a way to protect against poverty as a result of old age. When the bill was enacted in 1935, 65 years old was "old age". The average life expectancy was less than 60 years old for men and just under 64 for women. The number of people over age 65 and eligible to collect social security was less than 50,000.

However, 70+ years of modern medicine and more stringent health/workplace regulations have increased life expectancy to over 78 years. While life expectancy has increased by over 15 years, the age to collect Social Security has only went up by 2 years to age 67. As a result, in 2010 over 50 million people collected a total of $615+ million worth of Social Security. Instead of protecting against poverty as a result of growing abnormally old, Social Security now pays for 11+ years of a person's healthy life.

2. Transfers Wealth Out of Poor/Middle Class

The maximum contribution level for Social Security is $102,000. In other words, if you make more than $102,000, you no longer have to pay into Social Security. Hmm...

3. Women No Longer Dependent on Men

Back in the 1930s, women were much more dependent on men to haul in the money and support their lives. If something were to happen to them (either death or disability) and that income no longer came in, the ability for women to support themselves or a family would be significantly reduced.

Today, women are more educated than men and many are the main breadwinners in their households. The ability for families to continue to be supported after the death of one spouse is significantly higher.

4. It's a Terrible Investment

Last, but certainly not least, Social Security is a miserable investment. Each paycheck, Social Security takes 6.2% of your wages.

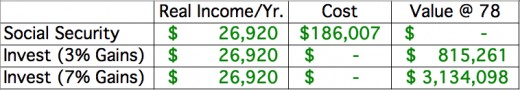

Assuming you started working at age 23 making $40,000 per year and maintained that level of income (after increasing for inflation) throughout age 67, you would pay a total of $196.043 into the Social Security system. At age 67, you would be eligible for Social Security checks worth $26,920 per year and increasing by inflation each year (roughly 3%). If you lived to be 78, you would withdraw a total of $382,050 in benefits. After taking out what you put in, that would be a net gain of $186,007 or a 95% return.

If you were to invest that same money into private investments at a wimpy 3% nominal interest rate, you could withdraw the exact same $26,920 per year. The difference is you would have an investment fund generating that income rather than receiving Government checks. Even if you withdrew the same amount of money from your investment fund that you would have received through Social Security ($382,050 over 11 years), you would still have $815,261 left in your investment account at age 78. If you lived to be 95, you would still have over $300,000 in the account.

If you factor in an appropriate portfolio of stocks-bonds, your nominal interest rate on investments would likely be closer to 9%. Even assuming a conservative 6%, your investment portfolio at 78 would be over $3.3 million. If you lived to be 100, you would have been able to withdraw your "Social Security" checks from your private investment account and still have over $10 million left over to pass on to your children and grandchildren.

If Social Security is to remain a part of America, it needs serious reform. If not, well - we may just be better off without it.

It's your turn! What do you think about Social Security? Should we keep it the way it is, reform it, or scrap it altogether? Leave comments below!